The Future of Finance: How Crypto Exchanges Will Give Way to Technological Solutions - New Banks

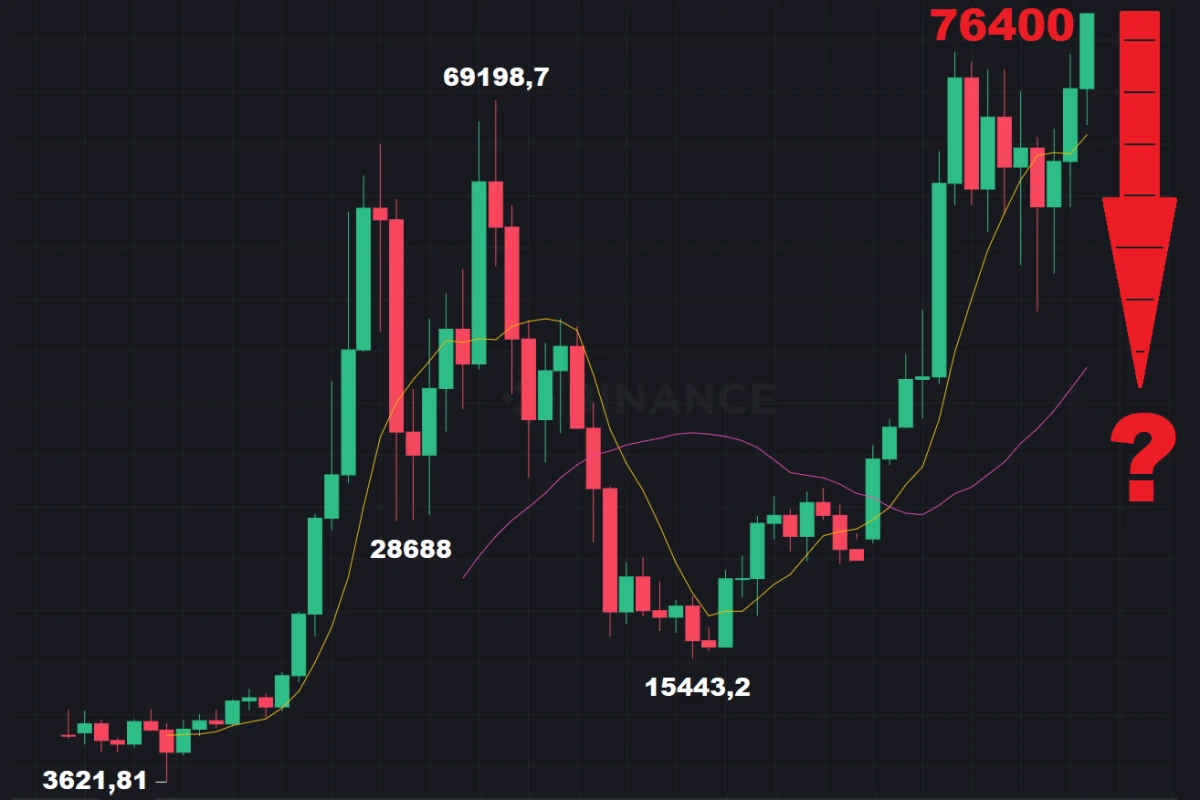

In a world where the financial system is rapidly evolving, the time for change has come. Crypto exchanges, once the reigning titans of the financial Olympus, may soon give way to new technological solutions and innovation-driven banks in the next five years. Let’s explore exactly how this will happen and what we can expect for the future!

When Old Times Meet New Technologies

Where are they? Crypto exchanges have, for better or worse, been true giants in the world of digital currencies. But like all heroes, they have their expiration date. More and more users are looking for secure and convenient ways to manage their assets. The rapid development of technology leaves them with no chance.

Why Will Crypto Exchanges Fade Away?

- Security First: Hacking attacks and scandals surrounding exchanges are becoming part of history. According to recent studies, about 80% of users fear losing their funds due to the lack of reliability of exchanges. New technologies, such as blockchain, offer reliable solutions with high security levels, including multi-level authorization and decentralized asset management.

- Fees That Kill the Mood: Why overpay when you can easily exchange cryptocurrencies on favorable terms? Average exchange fees in traditional services reach 2-3%, which is a significant drawback in a competitive market. New financial solutions promise low fees (below 0.5%) and instant transactions, making them attractive to users.

- Game-Changing Innovations: Crypto investors are already accustomed to smart contracts and decentralized finance (DeFi). This allows not only for exchanges but also for obtaining loans secured by cryptocurrencies, investing in liquidity, and generating passive income. New technologies offer possibilities that traditional banks can only dream of.

The Era of Fiat Money is Coming to an End

Fiat money, which was once the foundation of the global economy, is also gradually losing its significance. Why is this happening? Let's take a look at the main factors:

- Abandonment of Traditional Currencies: With the development of digital currencies, especially in countries with high inflation, more people prefer cryptocurrencies that are not subject to government control and inflation. This is observed in Latin America and Africa, where society seeks alternatives to fiat money.

- Decreasing Trust in Financial Institutions: Misconduct, corruption, and financial crises undermine trust in the banking system. According to research, over 60% of young people believe that traditional banks cannot solve their financial problems. This drives people to seek alternatives in cryptocurrencies.

- Technological Progress: Studies show that new technologies, such as artificial intelligence, blockchain, and financial technologies (FinTech), can replace traditional financial systems. AI-based services already offer risk analysis and recommendations that help users make informed financial decisions.

Technological Solutions: The Future of Finance

The new generation of banks is not only adapting to the market but also shaping it. They offer:

- Simplicity and Convenience: Mobile applications that can perform multiple functions are becoming an integral part of our daily lives. Interfaces will be more user-friendly and convenient, allowing users to carry out all financial operations with a single click without wasting time on complex procedures.

- Transparency That Users Want to See: By utilizing blockchain technology, users will have access to all their transactions and funds, meaning every step will be documented and under control. Data openness will allow clients to track their finances in real-time.

New Banks: What Can They Offer?

Modern banks do not intend to remain in the shadows. Their strategy involves:

- Flexibility Like in Gymnastics: Rapid adaptation to market changes and customer needs will become the primary criterion for success. New banks will be one step ahead of their competitors by introducing new features and improving service quality.

- Top-notch Customer Service: Forget about long lines and soulless contact centers. Personalized approaches and attention to detail – that’s what really matters! From chatbots to video calls with bankers – customers will access services in a way that suits them.

- Integration with DeFi Services: New banks actively integrate decentralized financial services, allowing users to obtain loans, earn on liquidity, and even invest in assets directly through their bank accounts.

Conclusion

The future of finance is not just about replacing one tool with another. It is a holistic evolution where crypto exchanges give way to new technological solutions, and traditional banks strive to find their place in this new reality. True success will depend on the ability to adapt to changes and implement innovations. Are you ready for these changes? Only time will tell, but one thing is certain – the financial world will never be the same.