Capital and marketing are the foundation of cryptocurrency growth.

In this article, we will explore marketing and capital as key aspects for the growth of crypto assets, as well as how large investors manage asset prices and public opinion through effective marketing strategies.

The Role of Capital and Marketing

Capital plays a crucial role in funding marketing campaigns. It allows for:

- Developing and implementing marketing strategies: Without sufficient funding, projects cannot conduct comprehensive advertising campaigns necessary to attract their target audience.

- Expanding the audience: With capital, projects can utilize various channels—from social media to traditional media—to maximize visibility and attract new users.

- Building trust: Well-funded marketing helps create a positive image that strengthens trust in the project.

The Impact of Large Investors on the Market

Large investors who hold a significant share of token issuance play a key role in asset management. They:

- Hire strong marketers: Investors understand that successful marketing is not only about attracting new users but also about managing the price of the token. Strong marketers develop strategies to maintain interest in the asset.

- Manage the price of the asset: Through marketing campaigns and PR activities, large investors can influence market trends, thereby increasing the token's value.

- Shape public opinion: Large investors use marketing to create a positive image of the project, aiding its promotion.

How Large Investors Use Capital and Marketing to Manage Prices

With significant capital, owning a substantial portion of token issuance and a professional marketing team, large investors can effectively manage the price of assets in the market. This process occurs in several stages:

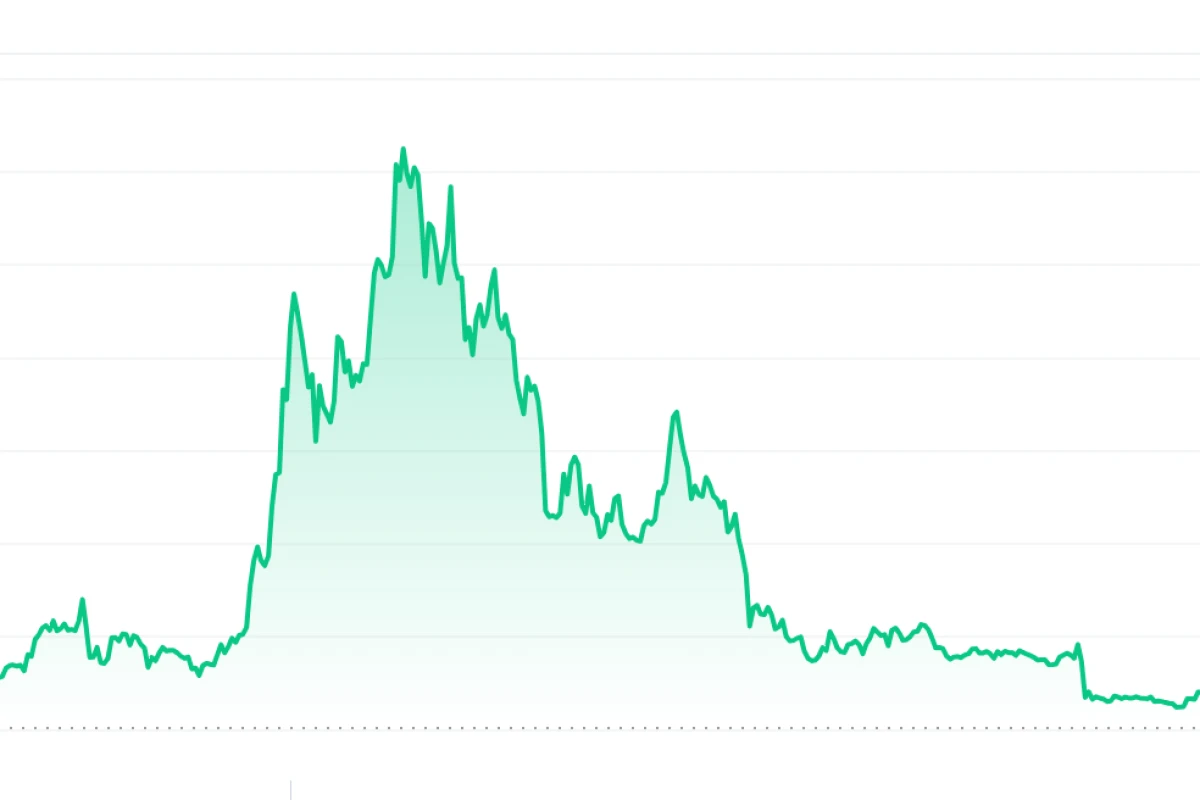

- Creating hype and raising prices: Marketers attract attention to the token by spreading news about growth prospects. This increases demand and the value of the asset.

- Selling at the peak: When the token price reaches a peak, large investors begin to sell their assets, taking advantage of the high price. This triggers a decline in value.

- Provoking panic and price decline: Negative news spread after the peak causes panic among users, leading to further drops in value.

- Repurchasing the asset at a low price: When the price falls, large investors repurchase the token at a lower price, repeating the cycle.

Conclusion

In the modern world of cryptocurrencies, capital and marketing are key elements that determine the success of crypto assets. Investments in marketing strategies allow projects not only to attract attention to their offerings but also to create a positive image that increases user trust. Large investors, leveraging their resources and professional marketing teams, can actively influence market trends, manage asset prices, and shape public opinion.

This interrelationship between capital, marketing, and market trends emphasizes the importance of a strategic approach in developing cryptocurrency projects. The effective use of these tools can not only ensure asset stability but also create conditions for growth. Thus, capital and marketing not only support the market but also become engines of innovation in the field of cryptocurrencies.