How Whales Bankrupt 90% of Crypto Investors: Market Manipulations and Their Consequences

The cryptocurrency market is known for its high volatility and unpredictability. Millions of people seek to invest their money in digital assets, but around 90% of investors incur losses. One of the reasons for this is manipulation by large players – whales that can significantly influence prices. Let's examine how they do this and how to protect yourself from such schemes.

Who are the whales?

Whales are large holders of cryptocurrencies who control significant amounts of assets, giving them the ability to manipulate the market. These can be:

- Individual investors

- Institutional funds

Whales usually hold hundreds of millions of dollars in cryptocurrencies, allowing them to change the market to their advantage.

Main manipulation strategies of whales

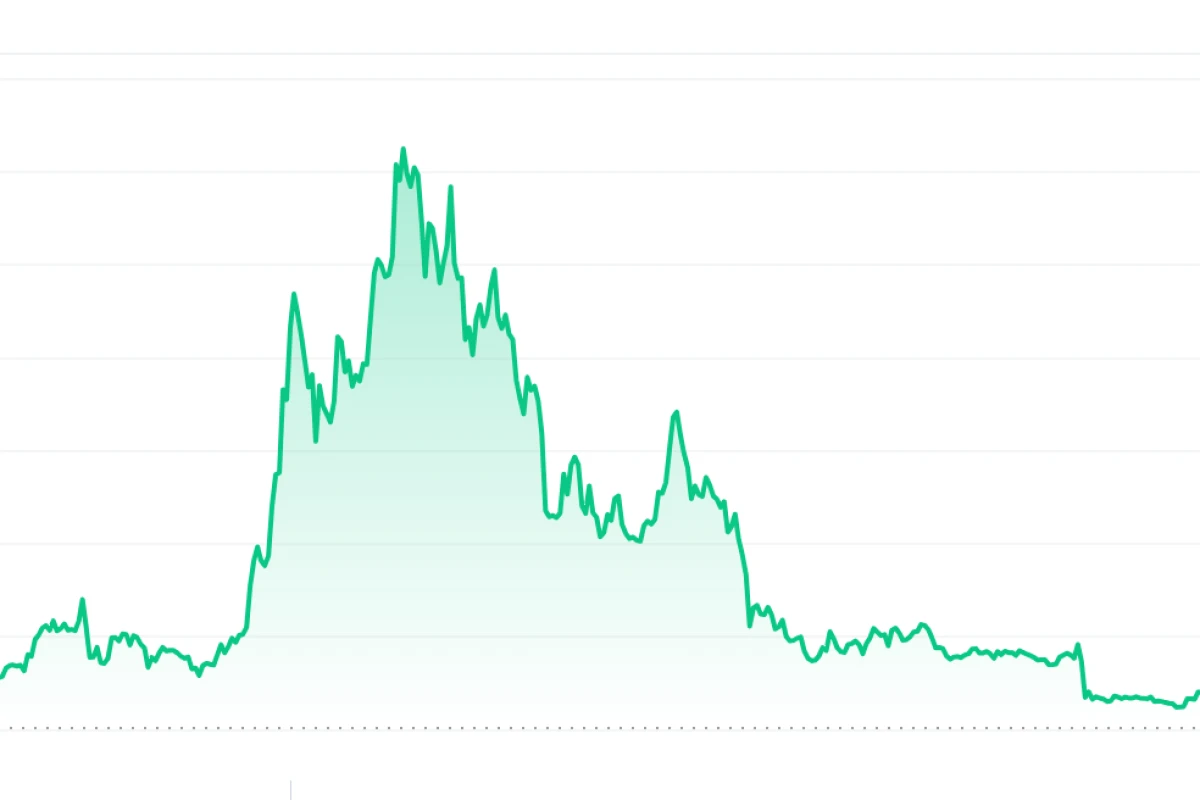

Pump and Dump

Whales massively buy cryptocurrencies, creating artificial demand. The price rises quickly, attracting small investors who hope for profit. When the price peaks, whales start selling massively, causing a sharp price drop. Small investors are left with assets that are now worth significantly less.

Wash Trading

Whales execute trades with themselves, creating the illusion of market activity. This leads to an increase in trading volume and attracts other investors. When small investors enter the market, whales stop the fake trades, and the price of the asset drops.

Spoofing

Large players place large buy or sell orders without intending to execute them. Fake orders create an illusion of demand or supply, misleading small investors. Whales can buy assets at a lower price when others start selling in panic.

Reducing liquidity

Whales can intentionally reduce the liquidity of certain assets, making the market less predictable. They halt operations, creating an illusion of stability, and then suddenly place large orders, causing sharp price fluctuations. This is especially relevant for little-known altcoins with low trading volume.

How to protect yourself from whale manipulation?

Tips:

- Market and asset research: Conduct thorough research before investing. Cryptocurrencies with low trading volume are more susceptible to manipulation.

- Avoid emotional decisions: Panic and greed are the main allies of whales. Don't get swayed by short-term price fluctuations.

- Use analytical tools: Modern platforms offer tools for market analysis. Track trading volume and use indicators to detect manipulation.

- Invest only what you can afford to lose: Cryptocurrencies are a risky asset, and there is always a possibility of losses. Invest only those funds whose loss will not be critical for you.

Conclusion

Whale manipulation is a reality of the cryptocurrency market. They use their advantage to gain profits at the expense of less experienced participants. However, understanding their strategies and maintaining investment discipline will help you minimize risk and protect your assets.

By following these recommendations, you will be able to better navigate the complex world of cryptocurrencies and reduce the likelihood of significant losses.