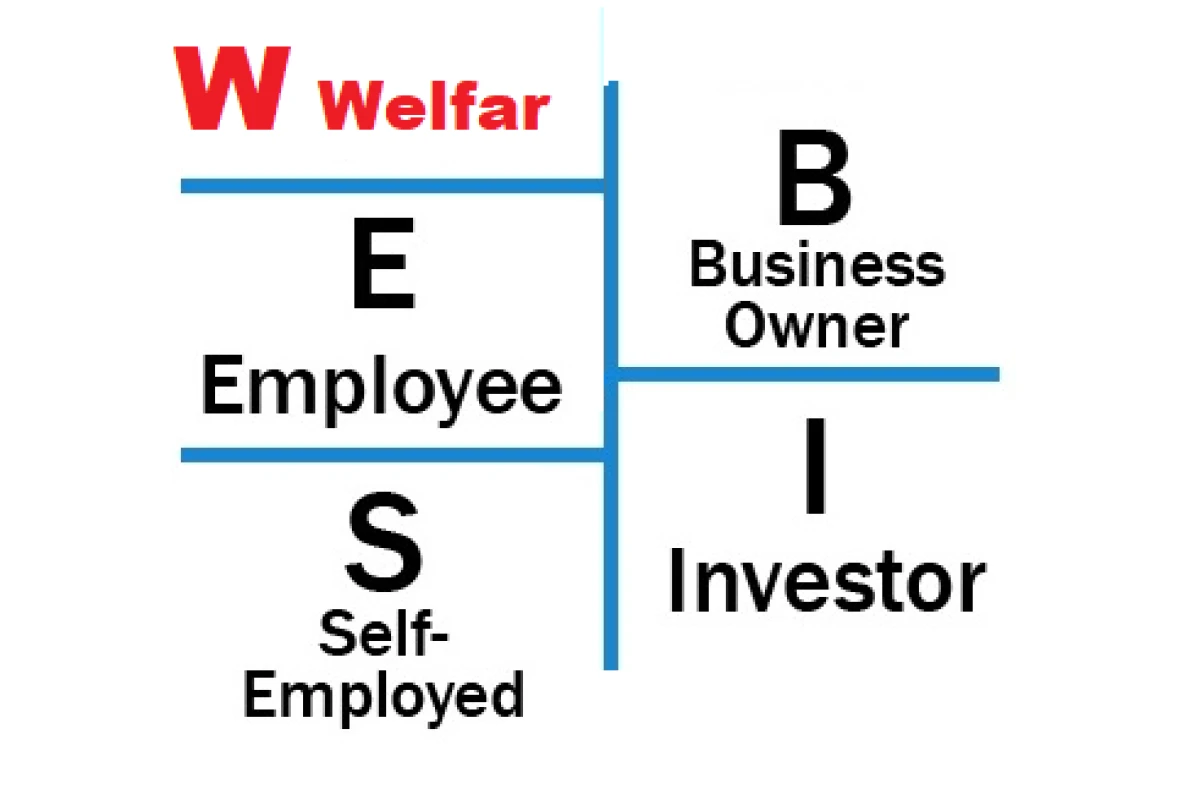

Robert Kiyosaki's cash flow quadrant model, presented in his famous book "Rich Dad Poor Dad", is one of the most well-known tools for understanding the different ways people earn money. Kiyosaki divides people into four categories depending on how they earn their income: E (Employee), S (Self-employed), B (Business owner), and I (Investor).

In today's world, where social systems and state support are becoming increasingly important, Kiyosaki's theory requires some updating. The rise of a new group of people who do not earn money through work, business, or investments, but rely on state assistance, calls for the addition of a new sector to the model — Social Sector (Welfare).

Robert Kiyosaki's Cash Flow Quadrant Theory

Before discussing the need to update the model, let’s take a closer look at each of the four categories proposed by Robert Kiyosaki:

1. E — Employee

People in this sector earn their money by working for someone else. They receive a regular salary, which gives them a sense of stability, but their income is limited because their salary does not depend on their performance or the number of hours worked. This is the most common way of earning money in society.

Example: Employees of large corporations, government workers, teachers, doctors, engineers.

2. S — Self-employed

People in this sector work for themselves, but they don’t run scalable businesses. These are small business owners, freelancers, consultants, and professionals who provide individual services. Their income depends on their own labor, but they have more freedom and flexibility than employees.

Example: Small business owners, freelancers, solo entrepreneurs, private doctors.

3. B — Business owner

People in the B sector own businesses where they employ other people. This means they run a system that operates independently of their own involvement. In this sector, one can earn much more than in the E or S sectors, but to achieve this, one must build an effective system and hire others.

Example: Owners of large companies, franchise owners, people who build scalable business models.

4. I — Investor

People in the I sector earn money by investing their capital into assets (real estate, stocks, bonds, and other investment instruments). They earn income from the assets they hold, rather than through labor. This is passive income, which, however, requires significant capital and allows one to earn without physical labor.

Example: Real estate owners, stock investors, shareholders of investment funds.

The New Sector: Social Sector (Welfare)

The new sector we should add to the Kiyosaki model is called the Social Sector (Welfare). People in this sector do not earn money through work, business, or investments, but rely on government assistance. This can take the form of unemployment benefits, social assistance, or other forms of state support.

Why should we add this sector? The social sector is becoming increasingly relevant as more and more people in many countries rely on social assistance as their primary source of income. Adding this sector will help better reflect today’s economy.

Reasons for Adding the New Sector

- Social support as a trend: In recent decades, social systems and state support have become an important part of life for many people. This is associated with a growing number of retirees, rising unemployment, and the development of social support systems.

- Changes in the labor market: In the face of economic instability, automation, and demographic changes, many people find themselves in a situation where they cannot find work or do not want to work and instead rely on government assistance.

- Social assistance as a standalone sector: People who live on government aid are not actively participating in the economy like employees, self-employed, business owners, or investors, but their reliance on the state makes them an important part of the economy.

How Would This Affect the Quadrant Model?

Adding the new Social Sector to Robert Kiyosaki’s cash flow quadrant model will help better reflect today’s economy. People who rely on social assistance do not fit into the existing quadrants as they do not earn money through work, business, or investments.

Created Table for Countries: Distribution of People by Quadrants and Social Sector

| Country | % of People in E Quadrant (Employee) | % of People in S Quadrant (Self-employed) | % of People in B Quadrant (Business owner) | % of People in I Quadrant (Investor) | % of People in Social Sector W (Welfare) |

|---|---|---|---|---|---|

| Sweden | 50% | 7% | 13% | 21% | 9% |

| Czech Republic | 63% | 7% | 9% | 9% | 12% |

| USA | 54% | 9% | 19% | 11% | 7% |

| Germany | 57% | 8% | 11% | 11% | 13% |

| United Kingdom | 56% | 10% | 14% | 13% | 7% |

| Austria | 59% | 11% | 11% | 13% | 6% |

| Poland | 60% | 11% | 9% | 8% | 12% |

| France | 55% | 11% | 15% | 11% | 8% |

| Spain | 53% | 12% | 7% | 9% | 19% |

| Italy | 53% | 14% | 10% | 10% | 13% |

| Netherlands | 58% | 10% | 12% | 17% | 3% |

The data was collected by artificial intelligence based on the analysis of various up-to-date information sources.

How Could This Impact the Global Economy?

- Increasing burden on state budgets: The growth in the number of people receiving social assistance leads to higher government spending on welfare programs. This creates additional strain on the budget, which may reduce the ability to invest in key sectors such as education, healthcare, and infrastructure. However, it’s important to note that not all those receiving assistance truly need it. Many people exploit the system without real necessity.

- Declining economic activity: People who are dependent on social assistance often do not contribute to the production of goods or services, limiting overall economic activity. This can lead to slower economic growth and negatively impact the labor market. Some of these individuals use the social aid system not due to actual circumstances but due to a reluctance to work or system abuse.

- Dependence on public funds: The increasing number of people in the social sector leads to greater dependence on public funds. This creates a vicious cycle where people cannot sustain themselves and become more vulnerable to changes in social policies or economic crises. At the same time, many recipients of social assistance make no effort to break free from this cycle, continuing to use the system without intention to change their situation.

Conclusion

Robert Kiyosaki's Cash Flow Quadrant theory clearly explains how people can earn money, but contemporary socio-economic realities require changes. Adding the Social Sector to the model could better reflect new social trends but also highlights the negative economic impact. Given the rising state expenditures and decreasing economic activity, it is important to develop strategies to reduce this sector. However, it is crucial to recognize that there are people who genuinely need assistance and cannot support themselves, while others use the system merely to avoid working and engaging in economic activity. It’s important to find a balance and encourage those who can work but choose not to, to become self-sufficient and actively participate in the economy.